Betting on the beta trade in healthcare ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Saturday, October 4, 2025 |

|

|

Welcome to The Strazza Letter, a free note with market insights from me, All Star Charts Chief Market Strategist Steve Strazza. |

|

|

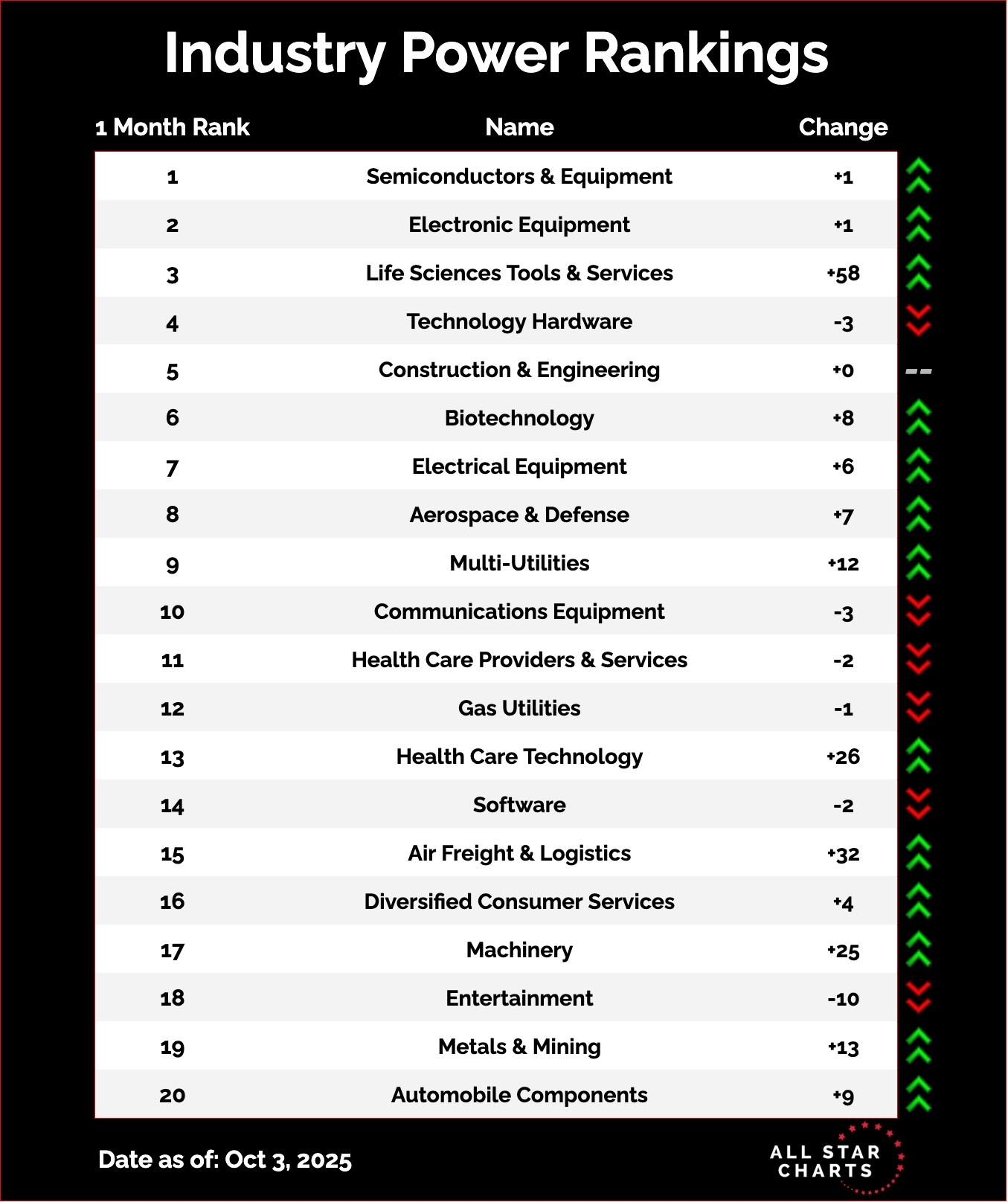

Welcome back for another Top Down Trade of the Week. This is a classic leadership scan. We start with the best sectors, then drill into the subgroups. We pick one, and then take a look at the top stocks in it. This week's standout is Healthcare, which jumped to the second spot in our sector rankings. |

|

|

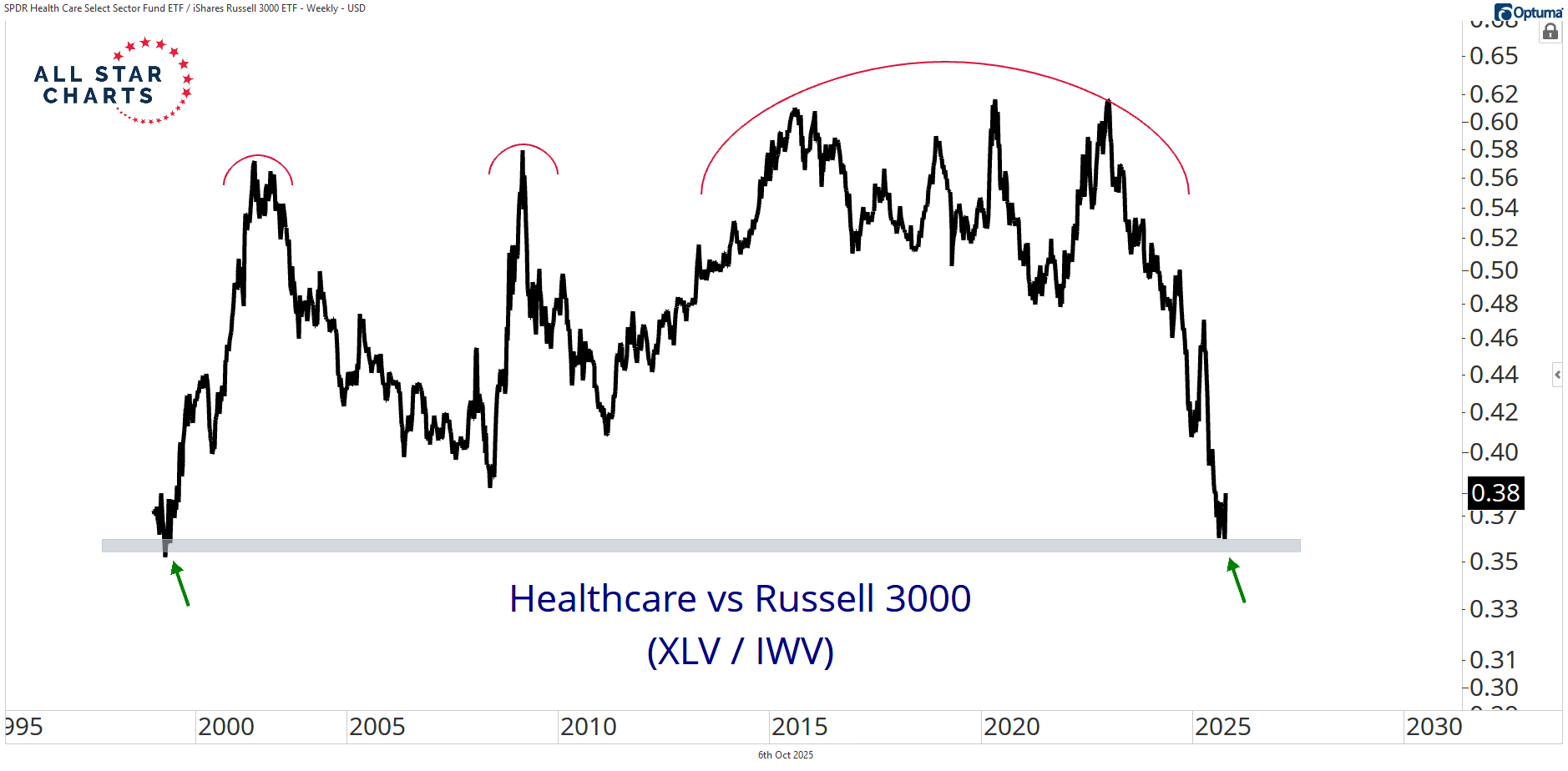

Healthcare is really waking up as the large cap SPDR fund just posted its biggest two-day rally since 2020 as well as one of its best weeks in history. XLV is also completing a classic bearish-to-bullish reversal pattern, adding weight to the case for a sustained rotation into the sector. Here's a look at our overall industry rankings, which show Biotechnology stocks climbing into the sixth spot. |

|

|

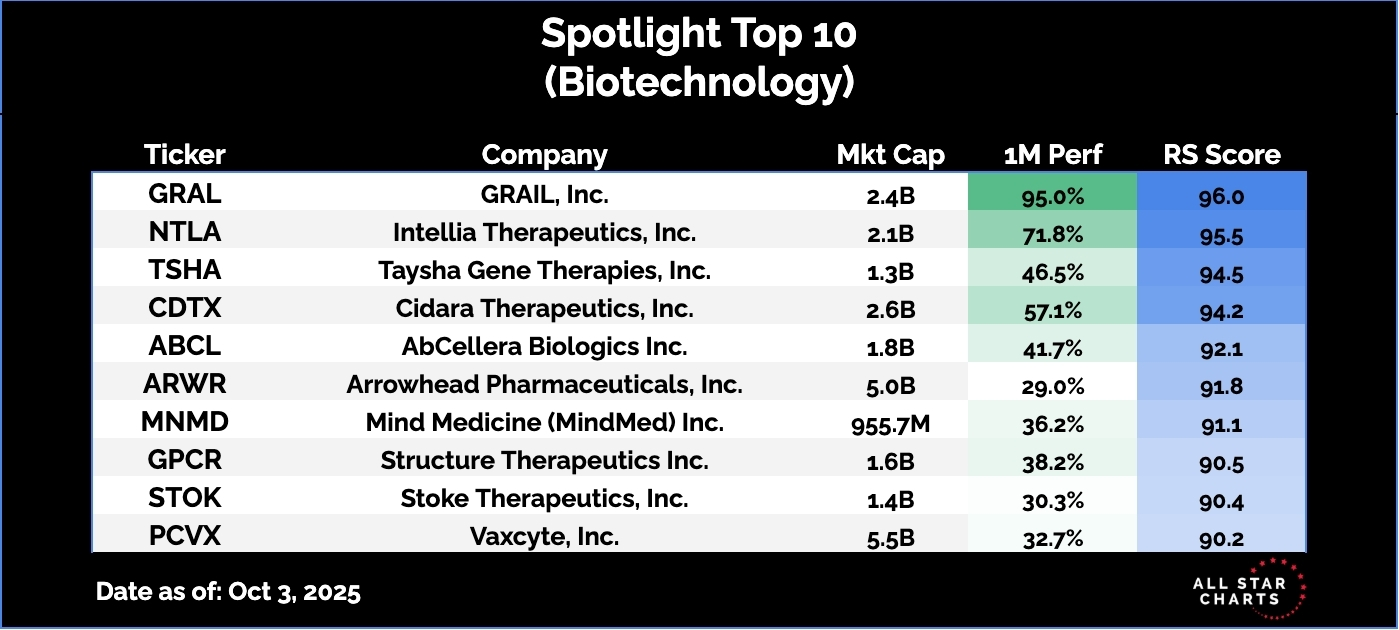

Biotech is the wild side of Healthcare — high-beta, high-risk, and usually the first place money flows when investors are on offense. So it makes sense to see the subsector toward the top of our rankings, acting as early leaders for their peer group.

Here are the Top 10 names in the Biotechnology subsector, ranked by relative strength.

|

|

|

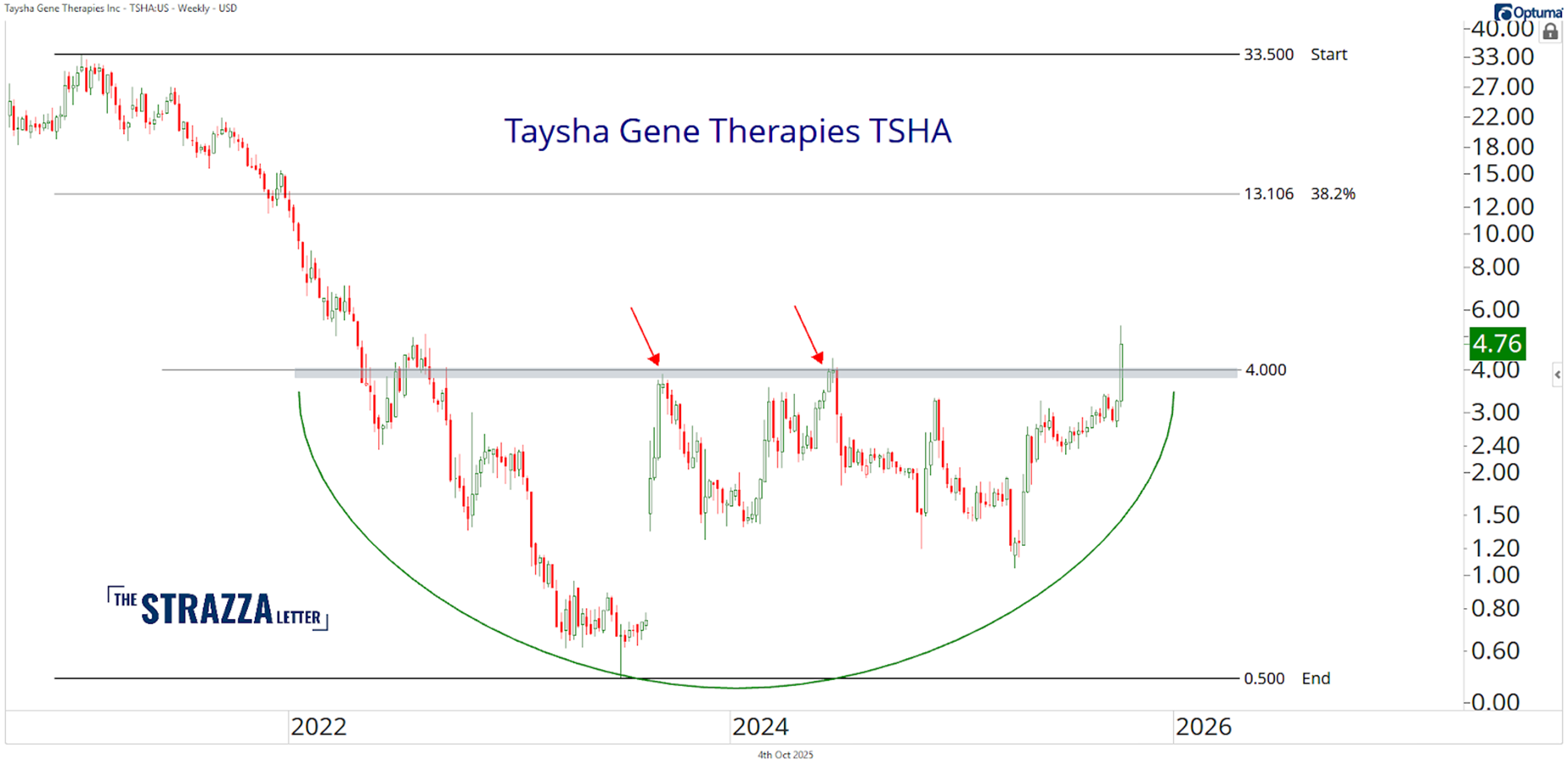

This week's spotlight stock is Taysha Gene Therapies $TSHA: |

|

|

This hot stock flaunts a 19% short interest and 8x days-to-cover ratio along with a price chart that is bursting through the upper bounds of a multi-year base. There is a good chance a short squeeze is being sparked right now just as the stock is reversing trend. Some short-covering could go a long way in fueling a swift reaction leg out of this pattern. As long as we're above 4, we like TSHA long with a target of 13, and a secondary objective of 34 over longer timeframes. Our team at ASC is constantly running these kinds of top-down scans. If you want access to our research and the trade ideas that come out of it, join us today—risk free. Cheers, Steve |

|

|

Steve Strazza | Chief Market Strategist, All Star Charts |

|

|

All Star Charts emails are a financial publication of general circulation and only offers impersonal advice, not tailored to individual needs of a specific client or group. Any comments or statements made herein do not necessarily reflect those of All Star Charts or its affiliates (collectively, "All Star Charts") and do not constitute buy or sell recommendations. Unless specifically indicated, this message is not an official confirmation of any transaction. The contents of any email communications to or from All Star Charts may be monitored or reviewed at All Star Charts's discretion. All Star Charts accepts no responsibility for any loss or damage arising in any way from the use of this transmission and any attachments; it is the responsibility of the recipient to ensure that they are virus free. If you reply to this email, please note that we are a public investor and do not want any material non-public information. We do not agree to keep confidential any information you provide and do not agree to any restrictions on our trading activity, except pursuant to a written confidentiality agreement executed by All Star Charts. |

Want to change how you receive these emails? You can manage your preferences here unsubscribe.

© 2025 All Star Charts 624 Broadway, Suite 405 San Diego, CA 92101

|

|

|

|

_01K6NPYMDT20W30BGXKXADEBEV.png)